The war in Ukraine has reminded us how fragile our world is, and how fragile our business links are after more than a decade of private equity, stock markets, management consultants telling us to be “lean” and have “just in time” supply chains. While this has resulted in squeezing more and more profit out of business over the past decade even in low-interest rate and low productivity growth environments, it has also made so much of modern business “fragile”, with limited ability to cope with unexpected and impactful events.

I have written about this several times, including in “What comes After What Comes Next?“, within which piece I reference Taleb’s thinking both on the idea of “Black Swans”, and then his follow up work on being “Anti-Fragile”.

My own business experience involves working internationally but living most of my adult life in the Cayman Islands, which are both an isolated small island group and also in a Hurricane Belt. For much of my time in Cayman, I was part of the leadership team for one of the largest employers, with multiple businesses spread across numerous sectors. We were very focused both on disaster preparation and planning, as well as on ensuring we had redundancies across our systems so that we were resilient rather than fragile.

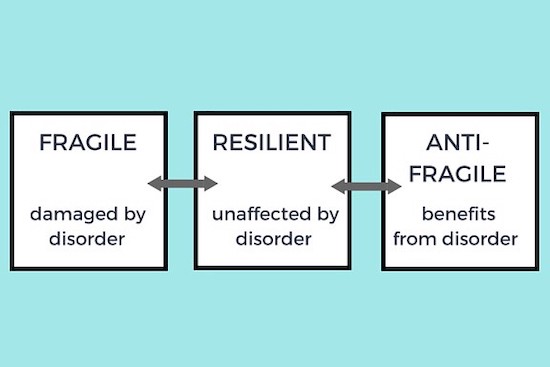

Now, the first level of not being fragile is to be resilient. However, in the case of our Cayman business, we were, perhaps, “anti-fragile”, which, as Taleb notes, is a level beyond resilient. Resilience is to have minimal impact at times of “disorder”, whereas an anti-fragile organisation actively benefits from times of disorder. In the case of our business, in 2004 when Cayman had a devastating Hurricane we managed our recovery far better than the majority of Cayman businesses. As such, we were ready to capitalise on change, as well as gaining a reputation for strategic and operational excellence that saw more and more business opportunities come our way.

Now, in order to be anti-fragile, one must first accept that this can eat into the idea of “profit maximisation” at a level beyond even being resilient, but perhaps it is time in our world of grey and black swans to look at optimising shareholder returns over the longer-term rather than maximising them over the short term?

Part of this can be taking some of our resources to be sure we are more anti-fragile. Part of this may (should, I would advise) also be to truly take care of our people so that they choose to stay with us thanks to our doing the right thing and looking after them at times of stress and pressure. Just as any sales organisation knows that it costs far less to keep a good customer than to acquire a new one, we can look at what it takes to keep our people rather than see them leave because we don’t put enough care (and money) into looking after them. At times of “disorder”, competition for the best people will only increase, so the anti-fragile (who will benefit) will be those who are seen to treat their people the best.

So, whatever it takes, ask yourself first how fragile your business is. After that, then truly consider how much short term profit you are willing to forego to invest in resilience. If you go beyond that level, perhaps you make the strategic choice to invest in being truly anti-fragile.

If that is something you are serious about, I’d love to discuss it with you. You can book a call with me in moments on my site here.