Apologies for being political for a moment, but amidst the constant focus in the UK on Brexit, the country (along with most developed countries) is doing far too little to address one of the greatest social and economic crises of our times, that of preventable illness and disease.

Today I want to illustrate this, but then, rather than talk about what the public sector can or should do, focus on what one private sector business has done to truly innovate in order to create societal behaviour change.

Crisis ? Yes, this crisis!

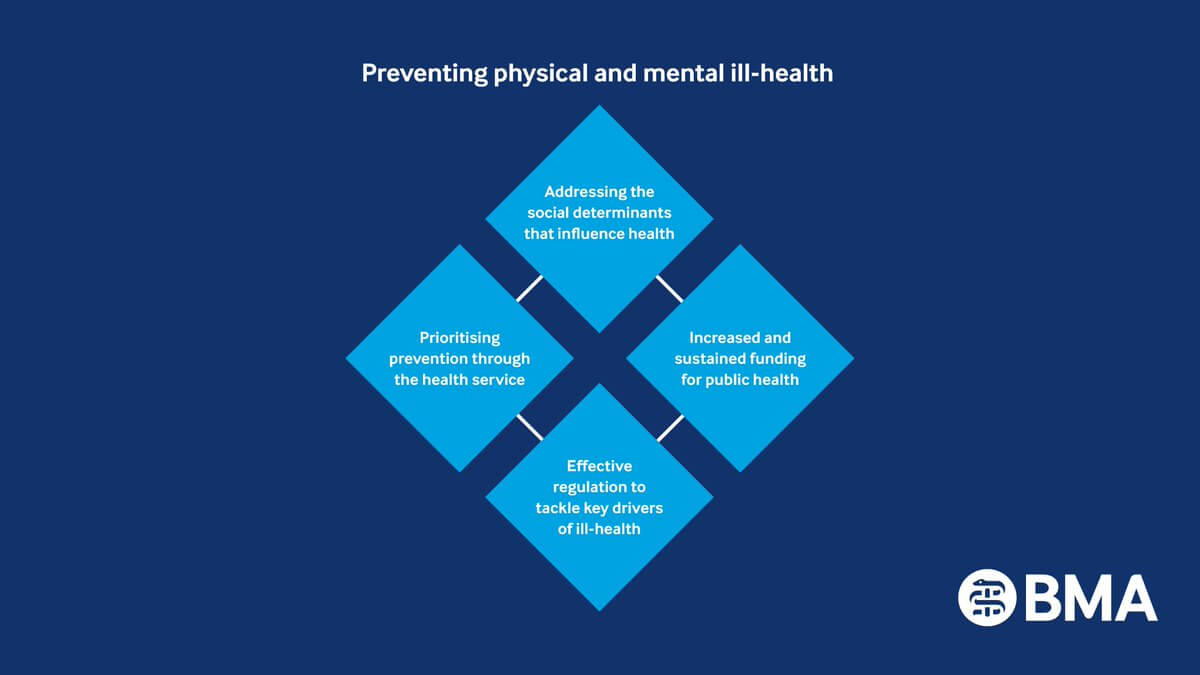

This from the BMA (British Medical Association) on 28 March 2019:

Prioritising prevention for population health

“..despite rhetoric, public health funding has been repeatedly cut in recent years as the BMA has consistently highlighted...This short-term approach is having long-term consequences on the sustainability of the health service...Preventable ill-health accounts for an estimated:

- 50% of all GP appointments, 64% of outpatient appointments and 70% of all inpatient bed days

- 40% of the uptake of health services may be preventable through action on smoking, drinking alcohol, physical inactivity and poor diet

The case for investing in and prioritising prevention is clearly compelling.”

By any measure, this is a crisis of massive proportions and I applaud the BMA report.

I do also note, though, that three of the four elements in the image above focus on “what can the government do” and none direct address the private sector.

I am a believer in business as a force for good, hence the “new triple bottom line” concept I developed of late.

Today’s article then is about how one business, Vitality Insurance, has hugely innovated by investing proactively to shift customer behaviours towards prevention rather than cure (they are in the medical insurance business) as well as to extend life spans (they re in the life insurance business too).

Innovating – with Vitality

I always like to understand the “why” of any business, and for Vitality it is:

Why we do it

We believe in the idea of ‘shared value’. It’s a unique approach to insurance, based on the scientifically proven principles of behavioural economics. We help you take a more active role in managing your own wellness, which can encourage you to develop healthy long-term habits that are good for you, good for us and good for society.

Attractive to me already!

So, back to the BMA report. As this highlighted, the developed world has a health crisis of massive proportions in terms of preventable illness and disease, whether that be obesity, stress-related illness, smoking and many more.

Now, in insurance, whether that be life insurance or medical insurance, the business numbers are based on underwriting. Basically, assessing, using lots of data, how likely it is that any individual among a population is likely to get ill or die, hence incurring costs for the insurance company. That insurance company then takes a view on that risk and prices its products accordingly.

Clearly, there are multiple ways such an insurance company can minimise their costs and so ensure they are commercially profitable.

All will look at the data on their clients to assess individual and collective risk.

All will also look at the cost of providing covered healthcare services for those customers when they need it and make a claim.

However, whilst a number of life and health insurance companies have taken a look at how they can encourage shifts in behaviour of their customers such that their likelihood of getting ill and so making a claim is reduced, none have taken it anywhere near as far as Vitality insurance.

My Vitality choice

Recently I decided, as a healthy 53-year-old male with basically no significant medical history, it was a good time to take out the type of “top up” (ie over and above the NHS cover) medical insurance commonly offered in the UK.

For my American friends, you may gasp to here that my research found I can get high-quality cover for under £100 per month from a wide choice of quality providers.

I chose a relatively new player, Vitality, who have over 1 million UK customers (and again this in a country with the NHS, where everybody already has quality free public healthcare).

What makes them unique is their focus on prevention.

I mentioned already that I pay under £100 per month for membership. I’m also a healthy individual who keeps fit and exercises regularly.

Value of benefits

I’ll list a few of the benefits (and approximate value to me) each year. Take note of the value of these and that they go way beyond affinity discounts. Vitality and investing premium income up front to shift behaviours in their customers on a massive scale.

- Apple Watch – 75% saving (as long as I exercise regularly) – value £300

- Gym membership – 50% saving – annual value (approximately) £500

- Runner’s Need – 50% off a pair of running shoes each year – annual value ~£50

- Ocado – savings on food delivery on healthy food – annual value ~£200

- British Airways – annual savings (based on how much I exercise again) – ~£200

Overall, easily as many savings as I actually pay in premiums, though I note that a) many do depend on you being a regular and vigorous exerciser, and b) hey, I don’t actually like gyms, but it is a cracking benefit 😉 !

Gameifying Preventative Health through Exercise

I sit here writing this with my relatively new Apple Watch on.

A core element of Vitality for their customers is tracking activity via wearables, whether that be an Apple Watch, Fitbit, Garmin etc.

The more you exercise, the more points you earn.

The more points you earn, the higher status level you reach, then the more discounts you receive.

Oh, and to begin they pay for you to have a basic health check (with blood test etc) that gains you points, with the more points you get based on being within healthy levels on such things as blood pressure, glucose, cholesterol etc.

We live in a world where more and more things are “gameified”, Vitality has done an amazing job linking (via apps on phones etc) many elements, to not only give you discounts linked to healthy activity, but also “bonuses”, such as a weekly Starbucks coffee and a cinema ticket every two weeks if you keep up basic activity levels.

In addition, imagine how much data they are now gathering to refine their own predictive risk models.

Finally, that is now well over a million people who, daily, think about how healthy they are being in living their lives.

In this health crisis yes, we need the public sector to step up and invest and do more for us, yet we also need the private sector to play their part in behaviour change, as well as each of us as individuals.

Right, I’m off to go for a walk, still have a few thousand steps to hit my target today!