Risk.

Understanding Risk is core to Leadership

Today some simple thoughts around what Risk means to us individually rather than as leaders of organisations.

Specifically, around what it feels like to be “at risk” and how that impacts our ability and willingness to “take risks”.

Even more specifically, how our personal feelings around being “at risk” may impact our ability to “take risks” in our job and our lives.

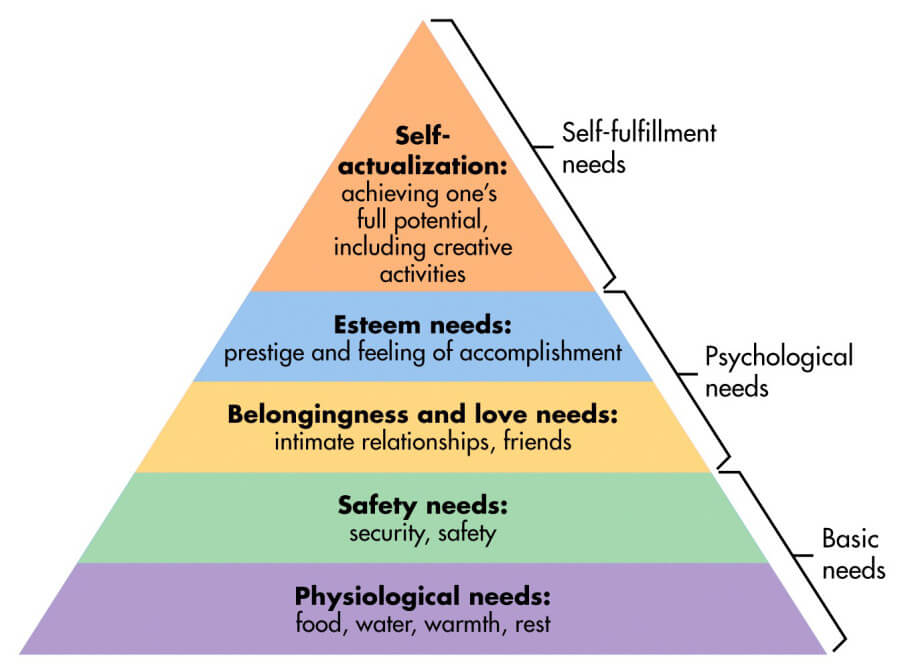

This is Abraham Maslow’s Hierarchy of Needs pyramid, one of my favourite psychology tools for awareness. For today, let me use Maslow’s pyramid concept to focus on financial risk on a personal level and how that can impact decision making for leaders.

The risk-averse CEO

Some years ago I was brought in to a company to work with the CEO as the Board was frustrated that the CEO was delaying decisions on business investments that this fast-growing company needed to make to keep pace with their industry.

That frustration was exaggerated by them feeling confused, as the CEO had previously been really positive and even aggressive in taking risks on behalf of the company, an entrepreneurial attitude that had hitherto allowed them to lead and thrive in their market and industry.

As I worked with the CEO and trust was established, it became clear that factors in their personal life had been having an impact on them. Family financial and health concerns had suddenly impacted them over the past year. Prior to this they felt very stable and secure both financially and in all other core areas of life. All of a sudden though, they felt very much “at risk” in different areas, including financially.

Now, let’s look at the pyramid concept and apply this to financial risk. Core to the pyramid concept is that if we don’t have a stable base to the pyramid we can’t go further up, so we must first consider that stable base.

If we feel “at risk” it will impact our ability to “take risks”, hence, in this case, the core reason for them delaying taking decisions.

Another simple and current example is of a mentee who was recently and unexpectedly made redundant from a job they loved. They are disappointed, angry, sad (going through the “five stages of grief” if you will), yet they also are at a life stage where they have limited financial commitments, plus their organisations gave them six months pay in their redundancy package. This financial cushion means they do not feel “at risk”, so they can take time looking at what they want their next career move may be and not jump into job hunting right away. As they do not feel “at risk” they can “take a risk” and at this point that simply feels like exploring widely what they are interested in, and perhaps then taking a sideways leap on the career “jungle gym” (our careers are no longer ladders but jungle gyms in the modern world!)

Oh, and back to the CEO, what did the business do once the CEO shared with the Board their feelings around risk and where they were personally? The Board considered how much they had historically valued the contribution of the CEO when that person had felt open to taking risks for the company. They then did two things. First, they simply gave them a long-term contract as CEO (to create a sense of financial security), then second, after reviewing the value of the contributions hitherto made by the CEO in decision-making, they gave the CEO a significant one time bonus, one that shifted their short-term financial angst.

Result? Once the CEO no longer felt “at risk”, they went back to “taking risks” in a way and at a level that the company’s own risk profile and culture needed.

How does “at risk” versus “taking risks” impact you?

Having read the above stories, how might you apply what you have learned here to your own thoughts around risk?

The stories talk about “situational risk”, so let me give you another core layer. We all have our own natural level of risk aversion or tolerance.

Some of us are natural risk-takers, some are not.

If you are not, stop torturing yourself with the “one day I need to quit my job and start my own business”. as you simply won’t do it, it will feel too risky.

If you are a natural risk taker, the type who flies a plane while building it, who bungee jumps then, on the way down, yells “remember to fix the cord to the bridge”, then do also have the awareness that others around you may not have as high a natural risk profile as you do.

So, both in terms of your natural propensity to risk and your current situation, consider how “at risk” you feel and where you might “take risks”.

Oh, and if you feel you can’t take any risks this year for various reasons, remember that sometimes the greatest risk is to stay where you are. For example, work for a retail bank in a “steady job” linked to customer-facing service? Consider that mega-trends will indicate that within just a few years that rapidly shrinking space will be all but eliminated. Sometimes the biggest risk is to not be proactive but to wait for something to happen to you. Choosing to make a move that may feel “risky” may be a far lower risk than staying where you are.