Two weeks or so ago I tweeted this as I saw people look at the stock market drop precipitously.

Two weeks or so ago I tweeted this as I saw people look at the stock market drop precipitously.

“In the short run, the market is a voting machine but in the long run, it is a weighing machine”~Benjamin Graham. I’m sure Mr Buffett is unconcerned with the market drop. To the contrary, he may say “be fearful when others are greedy, but be greedy when others are fearful” https://t.co/Phlpa3RnBh

— Tom McCallum (@TomCayman) October 11, 2018

This week I was in NY and had a meeting set up with someone around my age, yet they cancelled the meeting as things were crazy for them with market volatility and trying to keep their head while their clients were being very demanding.

The first book many people in investment are given to read is “The Intelligent Investor” written by Benjamin Graham many decades ago and yet as relevant today as ever.

Personally, though investing has been a large part of my career (and also supported me in supporting my family), I quite honestly could not tell you what is happening in the markets, I literally haven’t looked at it in several years.

On the other hand, I am fascinated by economics, human behaviours and longer-term shifts, hence my favourite quote is that Graham quote. The weighing machine looks at what Buffett calls intrinsic value.

Another Buffett thought is to imagine you can only make a certain number of deals in your life. If that were true, you’d be very, very patient about your investments. In my experience, the key is in being that selective.

In fact, as I paused drafting this post to go to an evening event, I then went for dinner afterwards with a group. One of them runs an investment fund that works carefully with up to 30-50 companies each year, abundantly offering them guidance and connecting them to what they need, before then investing in only about 4-6 companies each year. Very (very!) unlike the VC / PE world. Unsurprisingly, they build deep and trusting relationships in the broader ecosystem they work in, as well as deep understanding of the companies they invest in. This then results in metrics for investment success as an outcome of that source patience and care that are way beyond almost all funds.

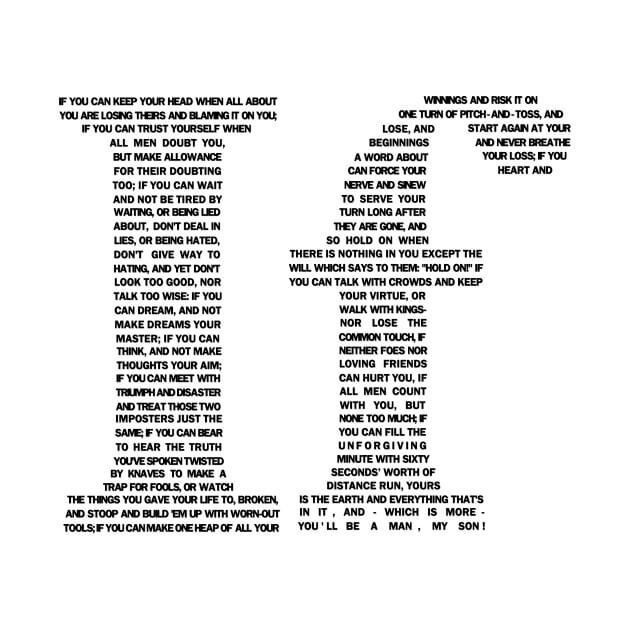

The key, then, is patience, or, as Kipling begins his famous poem “If”

“If you can keep your head when all about you are losing theirs”

If you can be patient, you can be present, selective, trusting, caring. Thousands upon thousands of investors, VCs, funds have capital to invest. If you are one of them, be patient. If you are an investee company, look for those that exude presence and patience.