Recently Dom Monkhouse shared an article on the “FIRE” movement on LinkedIn, commenting:

“I suppose this a different version of the “f**k them fund”. I always had three months wages saved up so that if at any point I got to a point where I wanted to leave a company I could.

I do see the value in taking that a step further and saving for early retirement, but perhaps this takes it too far. I’m not sure I’d enjoy years of sleeping on a camp bed or eating beans and toast every night to save the cash!”

The article is about the FIRE movement, which stands for “Financial Independence, Retire Early”. Case studies include people who retire as early as 30, through intense frugality allied with downshifting their lifestyle expectations.

I then posted a comment, a stream of consciousness riff on this, which I share below, unfiltered.

Now, before doing so, I do recognise (as far as is possible inside my own goldfish bowl) that I have had many privileges that mean I can say what I say. However, I share this to encourage you to look at your own lives. If you feel trapped in any way by the need to make money for a lifestyle, perhaps take a deep look at what is true, what choices you have made, what choices you could make. Perhaps things could be different for you?

What would be possible if you could consider yourself as “rich”? More freedom, less restrictions perhaps? For a story about this, take a look at this post for the “Greek Fisherman” story.

So, my LinkedIn riff. I hope it may provoke some thoughts :

“The paradigm so many people get into among higher earners I know in London is that they feel trapped by having to make x amount of money. While the FIRE movement is extreme, by shifting one’s relationship towards money first (to believe different options are possible), then being disciplined around why you are looking to save and invest, lots of other options are possible. As for me, I “retired” at around 35, but my definition of retirement was different. At that stage, I had set myself up financially to a point where I knew I could choose what I wanted to do. Not “FI” (financially independent), but instead financially relaxed.. knew that I had a certain asset base and also no particular interest in material things…so I do what I love.. and what I love also includes my work.. doing work that is aligned with who I am, my passions, my purpose… and I’m “rich” in that I know I can bring in enough money at any time.. funny how when you are aligned to your purpose and have built up some assets things feel more relaxed… end of riff!”

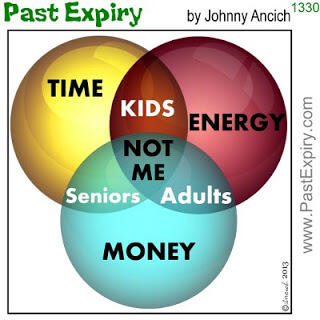

So, do you identify with any part of this Venn diagram?