{latest in a developing series on Smashing Paradigms}

For my story-telling explanation of the definition of a Paradigm, see “What is a Paradigm“.

One way of defining a paradigm is “an unconsciously held belief that limits us from fresh thinking” or “we’ve always done it this way”

(c) smasherofficial.com

Today some data to illustrate the issues around UK retail banking customer service, a personal example of how they can be in the paradigm of “we’ve always done it this way”, then an example of how that paradigm can and has been smashed !

First, some data. In November 2017 I went to a presentation by Vernon Hill of MetroBank put on by the Academy for Chief Executives. One key slide which had me laugh and nearly jump out of my seat was on Net Promoter Score. To simplify “NPS“, the score comes from one core question :

“How likely is it that you would recommend our company/product/service to a friend or colleague?”

To simplify, if there is an equal number of promoters and detractors in your client base, your score is 0. If it is negative, you have more promoters than detractors. A company with strong customer loyalty will have a score over 50, those around Zero, well, not good, not good at all !

When Vernon Hill put up the slide comparing the NPS scores for all the banks, the score for Metro Bank (more on them later!) was 78, excellent. THe highest score for any of the other full service retail banks was around 20, with one of them even having a negative score.

The phrase “shooting fish in a barrel” comes to mind !

So, now a story to illustrate the “old” way, then a little on how simple it has been to do it a “new” way.

So, the “old” way.

Exactly a month ago, I was looking to increase the credit limit on the credit card issued to me when I opened an account with one of the traditional UK retail banks when I moved to the UK about six months previously.

Having found that I could not request this online (as I would have preferred), I called the call centre. After relatively routine validation checks, a very polite representative took about 20 minutes to take information from me, then she placed me on hold so she could talk to someone in the credit department.

When she came back, she gave me the answer “no”, they would not increase my limit. I then asked to speak to that department and was told that was not permitted. I then asked for the reason why I was turned down. Suffice to say that the answer given was clearly irrational and illogical.

I then asked to speak to a supervisor, who was absolutely unempowered, could not give substantive answers or make any suggestions other than to re-apply. At this point I was amused and felt to carry this through as a (hmm) future case study on customer service !

So, when he asked me if I would like to make a formal complaint, I said yes.

The next day I saw four missed calls from an unknown number on my phone, then the day after that a very nice letter in the mail from a member of the customer credit team, saying she had tried to call, and could I please call her back, giving her name, phone and extension number. Oh, and she had also credited some money to my bank account as an apology for the prior service. So far, so good.

However, this is where it gets into “we’ve always done it this way” territory !

When I tried to call back to speak to this person, the operator then put me through no fewer than EIGHT security questions before they would put me through to the extension.

Imagine if that was your business and a customer wanted to return your call, would you put them through EIGHT identity check questions ? Wow !

Anyway, of course the call went to voice mail, and this started again. I’ll abbreviate now, to a point where a time was booked for them to call me about two weeks later to sort this out.

Although they called over four hours later than the agreed time (but by then my customer service expectations were so low that to get any call was a surprise!), in the end they only asked TWO validation questions. Phew !

They then asked what I would like the credit card limit increased to. I gave them a number and then said “that is only half of what I would have asked for, but the day you turned me down, I went online to another credit card company and they immediately opened a card for me. Not only was this all done online, but the limit they gave me was six times as high as the limit you have me on right now, plus I already have made that my primary card, so yours is my back up”. Ah well, merchant commission lost for them due to customer service, but I doubt they will notice.

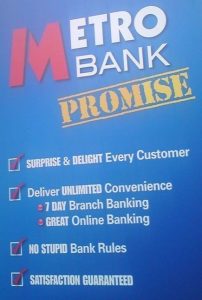

So, story over, now back to Metrobank. Vernon Hill is on a paradigm smashing mission, he is out to “kill every stupid bank rule we can find.” An example : “At other banks, just opening an account takes an act of god; we can do it in ten minutes”.

No wonder their NPS is in a different universe to the other banks !

What “stupid banking rules” equivalents might you have in your life or business ? What have you “always done this way” ?