Image from Seeking Alpha: “How Stock Buybacks Make The Rich Richer (And You Poorer)“

Nerd alert, today am diving into an area of finance and, through this, the leadership of corporations. I also predict in my crystal ball that, if you focus on this for your own investments, you can have a ready market for quality of corporate leadership by those who indulge in share buybacks and those who don’t

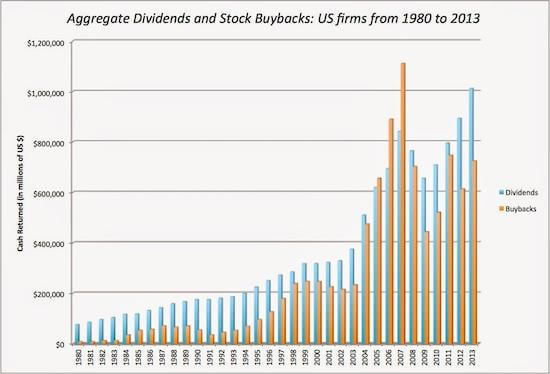

Buybacks by the numbers, per Tortoise Media:

- $6.31 billion – value of buybacks announced so far this year by Shell, BP, Burberry, Apple and Alphabet combined

- $1.3 trillion – total value of buybacks announced last year by the world’s 1,200 biggest companies

- 3 – factor by which buyback volumes grew in the decade to 2022

- 2 – factor by which dividends grew in the same period

- 4 – factor by which oil majors’ buybacks grew in 2021 alone

The Tortoise piece goes into some detail about share buybacks, but let me radically simplify this:

The only time that share buybacks are ok is when the business does not foresee a way to invest its free capital within the next several years.

Corporations raise capital, then add to that capital by earning profits, and then deploy the free capital generated to invest in future growth, from such investments as new products, acquisitions, improvements in processes to drive productivity etc. Capital allocation is meant to be to generate long-term profits and so capital growth. It is that simple.

Share buybacks, though, as I will explain, are for the short-term, the antithesis of long-term investment of capital.

So why are share buybacks booming, then? Since the GFC (Global Financial Crisis) of nearly fifteen years ago, the fashion for short-termism (corporations already have to report quarterly numbers) allied to financial engineering, aka massaging the assets rather than focussing on the core business, has rapidly escalated. To illustrate the short-term nature, a share buyback gives a “sugar rush” of boosting EPS (Earnings per Share) as, quite literally, there are then fewer shares remaining in issue. This returns capital to those who are bought out, but then leaves less capital for the corporation to invest in its long-term future.

The keen-eyed among you will have noted that earlier I said “the only time that share buybacks are ok is when the business does not foresee a way to invest its free capital within the next several years.”

My definition of a Strategic decision is one that will only generate returns 12 months or more into the future. Yes, there are rare exceptions to that where returns can come closer, but strategic decisions need “patient capital”.

- When it comes to investing in new products, they will typically take several years to be developed, introduced to the market, then mature and develop market share and profits. Long-term, not short-term.

- When it comes to acquisitions, one cannot predict when the next acquisition opportunity will come up, and the larger the acquisition, the less predictable that is, yet the more capital needs to be retained to be ready for the opportunity. One must, therefore, keep a large amount of free capital free for what could be a long time if you want to be ready to “pull the trigger” for the right opportunity. To study this more, study Berkshire Hathaway. Warren Buffett and Charlie Munger are the absolute masters at having huge amounts of free capital ready, whilst also having the patience to wait. Again, all of this is long-term, not short-term.

- When it comes to improvements that drive productivity, again these take capital and time to fully pay dividends. When you set up a development programme that sends future leaders in their 20s around the world within your company, the investment is significant, but the overall return one or more decades down the line from the experience and relationships gained and built can be stratospheric. Deep investment in your Culture is similar. Long-term investment, massive long-term benefits

In short, any time I see a company planning to make share buybacks, a flag is raised for me. If it is a company I am a trusted advisor too, my questions for them are direct and tough. Yes, there can be valid reasons for share buybacks, but all too often they are about the short-term, not the long-term, and leaders are there to be stewards of the capital invested by the shareholders and that is, in almost all cases, a long-term responsibility.