This week I was reminded of the importance of finding the right balance between Trust and Transparency when my brilliant friend Dr Carrie Goucher noted in a LI post:

Someone recently described the “tsunami of comms every time I open my laptop.”

Working transparently is brilliant until there is so much flying around, it’s overwhelming and impossible to keep up.

My reply was instinctive:

Transparency is not a universal good.

Transparency can even be potentially toxic.

Transparency can indeed increase friction.

Trust is, however, a universal good

Finding the balance is key.

Example.

If a manager insists on everything their team does or says being shared transparently, the “tsunami of comms” can easily become overwhelming (I’m looking at you, Slack 😉).

If, on the other hand, that manager chooses not to read any email or Slack message that isn’t directly addressed to them (I used to make a habit of filtering any messages where I was only ‘cc’d’ to a junk folder), then, if communicated and executed correctly, can both reduce friction and leave team members feeling empowered and trusted.

I was also reminded this week, while listening to an address in London by the Cayman Islands Minister of Financial Services, Andre Ebanks, that Cayman has, for decades now, been repeatedly forced by larger countries and groupings (eg the EC) to be more and more transparent with offshore financial services. Yes,

This has long since gone beyond the point of creating needless friction, such as where Cayman Islands authorities are now literally (on occasion) asking investors in certain Cayman-regulated entities for due diligence on every ultimate beneficiary. This can include investors who are some of the largest institutional investors in the world, so can represent hundreds of thousands or even millions of ultimate beneficiaries.

To name but two such global investment entities:

- CalPERS (California Public Employees’ Retirement System) has over 1.5million members and is regulated by the State of California among other US regulatory entities

- OTPP (Ontario Teachers Pension Plan) has 330,000 members and is regulated by the Province of Ontario and other Canadian Federal Regulators

So, one can see that Transparency is going too far if people are being asked for due diligence on CalPERS or OTPP members, plus what does it say about the lack of Trust of other regulators?

This is not a new song to sing. In fact, nearly five years ago on this site, I wrote the blog: “Transparency versus Trust?“, in which referenced Cayman:

Do shareholders in a business insist on going into that business and checking the work of any or all staff at a detailed level? Of course not, it would be incredibly inefficient to do so.

What do they do instead? They appoint qualified and experienced managers, they implement systems, processes and controls.

As a Caymanian, I am considering why there is such a drive from the UK Government to insist, in the name of transparency, on open registers of all owners of companies.

The Cayman Islands Government already has qualified and experienced managers, systems, processes and controls that are efficient and effective ways to ensure criminal and other ownership issues are open to the authorities of other nations.

Why insist on such a level of inefficient transparency then?

Could the answer be simple, that the UK doesn’t truly trust the Cayman Islands? Despite the diplomatic talk from the UK of the importance of the relationship between the two countries, it is a universal truth that trust is at the heart of all relationships. Does the insistence they are making on transparency indicate that the trust between the countries is damaged?

This was very nearly five years ago. I am not involved in the details, so perhaps there has been more and more trust built and being reflected in the trust of cross-border agencies, laws, and regulations. However, the situation I mentioned about due diligence on ultimate beneficiaries of large institutional entities is not hypothetical. It is happening, right now. It makes no sense to me when the other choice is to build trust.

I also wrote about this choice over four years ago, noting:

Today a concise thought around the power of slowing down to build trust and how that can then accelerate decision-making and action. This was from a reply tweet I made:

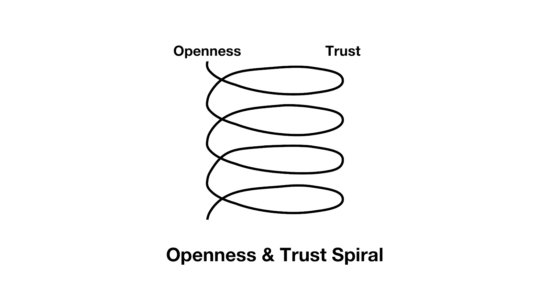

I encourage the adage “slow down to speed up later”… relationships are still one of the most powerful tools for business (and life!), and, as you say, trust takes time to build… so slow down and take time, as once trust is deeply held, speed of decision and action is faster

Trust does take time to build, yet when it is truly solid, the speed of thought, agreement, action can be so much faster.

Take time to invest in building trust, the ROI can be immense!

I hope both Cayman and those seeking to impose ever more onerous transparency requirements upon Cayman may instead choose to have a conversation that is less about “what additional requirements can we impose around transparency” and more centred upon the question:

“What would we need to have in order for us to truly trust each other?”