Prepare for higher mortgage rates

I’m an optimist and always positive about human potential. At the same time, though, the Chartered Accountant in me is also pragmatic. One adage I follow at times of uncertainty is, therefore:

Prepare for worse, hope for better

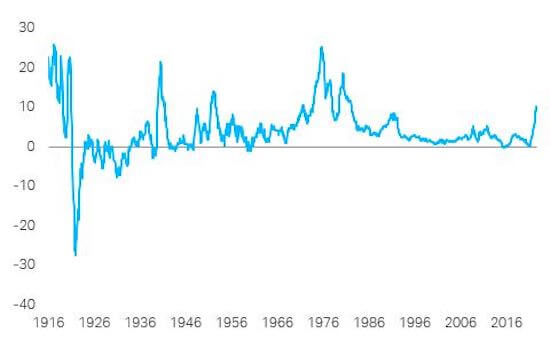

Now, take a look at that chart above (thank you to the brilliant Dario Perkins for sharing this). It shows historical inflation numbers in the UK as per the Bank of England.

Can you see how scary the current spike is ? The worst in well over forty years.

Now, look at the previous spike in 1988/1989. I’ll tell you a story from back then, but first note this adage too:

“The best predictor of future behaviour is … past behaviour”

We will see similar behaviour from banks and consumers as we did back in 1988/1989.

At that time I had just managed to get on the property ladder aged 22 (these were different times, as I have written about before the flat that cost me under 3x earnings would now be 10x earnings for the same flat for someone in the same job!). Soon after getting that flat, though, my mortgage interest rate (the only option back then was floating variable rates) spiked up to (hold on to your hats) 14.25%. I literally didn’t go out for months, had to scrape by on (yes) beans on toast and other such cheap staples.

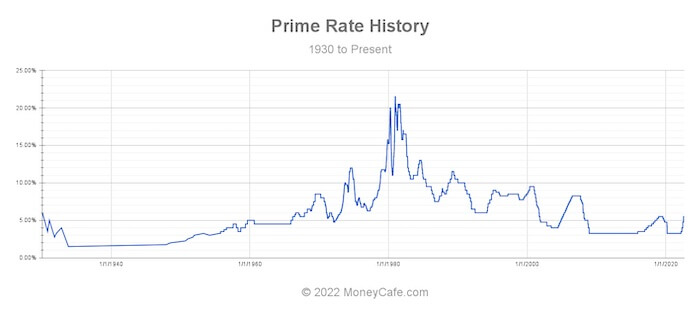

For those of you under, well, about 50, the world operated in the 80s and most of the 90s with much, much higher interest rates than we have now. Even in 1992, my first property in Cayman had a mortgage rate of 12% (Prime rate of 10% + 2%). You can bet I repaid that as quickly as I could with monthly overpayments etc! Current rates in Cayman are now typically Prime Rate +0.5%, so right now 6%. Imagine 6% today, UK readers?

Prime Rates in USD. Look how low and steady they got post 9/11 until the Pandemic and then the recent rate spike

Now, please take all of that in and consider that, even for those of you with protected fixed rates in place, your next interest rate might be 6%, 8%, or even 10% or more.

Prepare for worse, hope for better. Run your numbers on various (much) higher mortgage interest rates and see what happens to your household budget. You may want to put off any discretionary spending, home improvements, or big vacations. The future is not looking good.

For businesses, similarly, run some scenarios at higher rates of interest (as well as inflationary pressures on your supplies, staff salaries etc), then look at what you feel the market will bear in terms of your own pricing. In summary, it won’t look good, so review closely your finance options. Those who have the funds to get through the next few years will be in a position to do very well, as many will not have the financial strength and so will suffer and leave space in their market.

Now to finish with two Warren Buffett adages:

“the easiest way to make money is to think longer term than the next person”

So plan ahead

And

“Be fearful when others are greedy and greedy when others are fearful”

So, if you can be resourced up for it, hold off and wait, the fish will be easy to catch when the tide goes out.