Predictable ups and downs: working with chemo cycles

Today is Day 5 of my 3rd (of 4, yay, done in less than a month!) Chemo cycle. Despite other meds to try to moderate feelings of sickness, I feel pretty rubbish.

This is absolutely predictable. Each 21-day cycle I start to feel the meds making me feel “toxified” by about Day 3, then feel rough until about Day 17, ie three days after the last tablet.

That gives me about 7 “good” days out of each 21.

In that “good” week or so, it is difficult to remember how rough I feel during the tough weeks. In the tough weeks, it becomes increasingly difficult to remember how it feels to not be under the toxic impact of the chemo chemicals. That feels interesting to me as to how my mind works.

Anyway, one of the learnings from this flipping from “rough” to “normal” every three weeks has been a reminder that when we have predictable ups and downs we can work with them. In fact, we must work with them else we will simply be frustrated.

In my last “good week”, I made the most of it, including:

- A “walk and talk” meeting

- A day out in London with one of my sons

- A drive with that same son to explore parts of the area I live in, plus a food truck lunch at a craft brewery.

- Visited a gastro pub I hadn’t tried before.

- Several meals out, even as simple as brunch at a local café

Now I am on the “rough” period, I keep a relatively light schedule, talking to clients and other over zoom and looking to do those between about 9 and 4, the times of day I feel at my best. I’m not venturing far from my front door as quite fatigued. Happily, Wimbledon is on right now and the sun is shining, so happily a couch potato late afternoon and evening.

Predictable ups and downs in business: Recession is coming

In business, we also have predictable ups and downs. We either accept them and proactively work with them, or we forget that times will not always be the way they are today and we fail to plan (therefore plan to fail).

One major and predictable “down” is that much of the Global North (and particularly the UK, for various reasons) is heading both into recession and a period of high-interest rates and inflation. This is predictable and will have a major impact on businesses. What to do about it? Right now I recommend you “cash up” if you can. Look at your Balance Sheet, do whatever you can to make sure you have reserves for the lean times ahead.

This is one tip for today on a predictable “down”. For those that have strong Balance Sheets, it is also predictable in our highly over-leveraged business world of the last decade and more, that opportunities to buy businesses (and other assets) for low prices will start to appear. They will be there for those who have funds to invest.

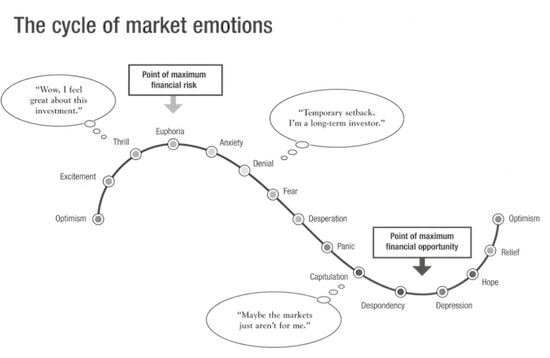

The image above is from a blog by Darius Foroux, I recommend following him via his email newsletter, he writes weekly on varied topics and is always thought-provoking.

As you can see, this image also illustrates cycles in business and markets.

As for me, as I wrote about yesterday, I’m working with cycles in buying a new car. We’ve seen a supply chain issue on chips for new cars driving used car prices up in the UK, but that is now coming to an end. At the same time, with petrol prices jumping, people are down-sizing their cars. I’m working with both of these ups and down to sell my existing car (which has great fuel consumption) at three years old for the same price as I paid for it at one year old. Crazy that it hasn’t depreciated, but now is the time to sell. I’ll then upgrade to a car that is the same age but with a larger engine and perceived to be less frugal, so less in demand. I’ll have this fun car (that I drive less than 5,000 miles per year, I avoid using the car as much as I can in favour of trains, walking, cycling) for at least a few year, by which time the next predictable cycle (of moves to electric cars) comes along.

As to investments, I hold a large number of crowdfunding investments in early-stage companies. Every quarter or so I evaluate both the individual company results and also the overarching market. One that I hold has a niche serving the food delivery business. I sense that this will take a major hit as the recession bites, but then may still be strong as people stop going out and instead treat food delivery as an affordable luxury. We shall see, but I always look at what is predictable, even if we can’t see and feel it right now