This is the look of a batter striking out swinging.

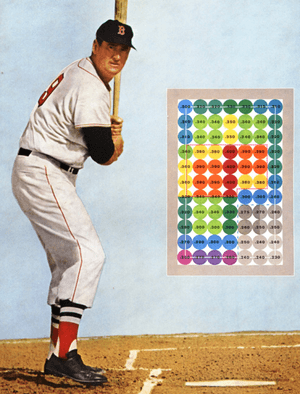

This is a picture from the book, “The Science of Hitting” by Ted Williams, where Ted broke the strike zone into 77 baseball-sized circles, colour-coding each one based on where he had the best chance to hit the ball.

He knew his sweet spot and waited patiently.

Ted Williams did not swing at every pitch.

Ted Williams was the last player to bat .400 for a season.

77 years ago.

Today, lessons from Ted Williams and Warren Buffett on patience.

A quick primer first on baseball for our global audience.

In baseball, a star batter “bats 300”, or puts the ball in play 3 out of every 10 times they come to the plate. When they come to the plate, the pitcher throws pitches to them. If they let the pitch go by and it is outside the “strike zone”, that is called a “ball”. If they let four “balls” go past, they get to “walk” to first base without having to swing the bat.

If they swing and either miss or hit the ball out of play, that is a “strike”. If they have three strikes, they are out. The other way to get out is to hit the ball in play and either be caught or run out by the fielders throwing them out. {I tried to simplify it!}

Ted Williams had the highest career “on base” (a combination of walks and hits) percentage in history. In 1941, 77 years ago, he was also the last player to bat 400, with a season average of .406.

I wrote about Warren Buffett earlier this week around the theme of patience, but from a different slant from today’s post. In “Patience, Venture Capital, Buffett and Kipling” my focus was on ignoring the opinions and behaviours of others, instead of staying focussed upon what you know to be true, based on our own measures and values.

Today’s blog is also about patience, but it is also about waiting for the “pitch” that you know is in your own “sweet spot”, or, as Buffett puts it, “circle of competence”.

Sometimes we are presented with opportunities that we feel we must take, but where one truly takes time to, socratically, “Know thyself”, we can choose to let the pitches outside our sweet spot go by.

This can be in any area, such as:

- Start-up businesses

- to whom often their ideal client is “one who can pay”, no more selective than that – take time to choose the right client not just for this month’s cash flow but for the business you are building

- Building your business

- Take time to, again, know your business. Yes, be opportunistic but also be clear on the end you have in mind. Who are you? Why do you exist? When you get clear on your why, the how is easy, and that includes elements such as values and how you behave with each other and with your clients. Many businesses don’t take time to build patiently in this way and almost always regret it later. “Slow down to speed up later”

- Recruitment

- In the urgency to fill a vacancy in a busy company, often hires are made based on such pressing need. So often that is a mistake. Hire slowly when you can, make sure the “fit” is there, that they are in your sweet spot

So, what does Warren Buffett have to say about Ted Williams and sweet spots?

First, I refer you to the single greatest resource I’ve ever seen for investment wisdom, the annual letters he has written to shareholders of Berkshire Hathaway every year since 1965. In 1997 he wrote:

“We try to exert a Ted Williams kind of discipline. In his book The Science of Hitting, Ted explains that he carved the strike zone into 77 cells, each the size of a baseball. Swinging only at balls in his “best” cell, he knew, would allow him to bat .400; reaching for balls in his “worst” spot, the low outside corner of the strike zone, would reduce him to .230. In other words, waiting for the fat pitch would mean a trip to the Hall of Fame; swinging indiscriminately would mean a ticket to the minors.

If they are in the strike zone at all, the business “pitches” we now see are just catching the lower outside corner. If we swing, we will be locked into low returns. But if we let all of today’s balls go by, there can be no assurance that the next ones we see will be more to our liking. Perhaps the attractive prices of the past were the aberrations, not the full prices of today. Unlike Ted, we can’t be called out if we resist three pitches that are barely in the strike zone; nevertheless, just standing there, day after day, with my bat on my shoulder is not my idea of fun.”

So, at that time, 1997, he was finding few pitches to swing at, or so he said.

History shows he was bluffing, to a large extent. In the years right after 1997 the canny Mr Buffett made some of the biggest deals in the history of his company, and history shows some of them were home runs hit WAY out of the park and are still holdings of Berkshire Hathaway, with much of the total return made on the price he paid at teh outset.

He knew to be patient and not swing at every pitch.

The year before in his 1996 letter he also wrote:

“Intelligent investing is not complex, though that is far from saying that it is easy. What an investor needs is the ability to correctly evaluate selected businesses. Note that word “selected”: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.”

Like Ted Williams, Warren Buffett took time to be very clear on his sweet spot, his circle of competence.

Know your sweet spot, have patience and only swing at the pitches that come to you there.