“In the short run, the market is a voting machine but in the long run, it is a weighing machine”

These words are from Benjamin Graham, author of “The Intelligent Investor”, who I referenced just the other day in “Patience, Venture Capital, Buffett and Kipling”

The other day I also saw a tweet by my friend, the brilliant and impassioned and purposeful economist Marla Dukharan:

I wonder why more people in the private sector don’t realize that ‘saving the world’ makes good business sense? Unless your business model somehow directly makes this a better place, then your de-facto goal is mutually assured destruction, whether you acknowledge that or not.

— Marla Dukharan (@Marladukharan) October 28, 2018

“We are what we measure” is an old adage, so today let me simply reflect on one answer to Marla’s question, anchored by the latest Harvard Business Review report on what they call “The Best-Performing CEOs in the World 2018”

Let me also note that it takes a brave leader to buck that status quo. One such CEO (who I won’t name here) in the UK has just been unceremoniously dumped by their organisation for what I believe is the sin of choosing to lead their firm in the direction of being about more than short-term profits for their owners, but instead being of broader worth to their stakeholders and broader society.

If you lead an organisation, please take a look at this analysis below, then consider my closing thoughts and ask yourself how you will measure yourself.

I said about the HBR article “what they call” the best performing CEOs, as once again “we are what we measure” and the business world keeps focussing on the short term, on the “voting machine”, on purely financial metrics.

In terms of pure investment performance, we continue to focus on market sentiment and so the short term over the longer term. This, despite Ben Graham’s words, echoed over the decades by his most well-known student and mentee, Warren Buffett, who has achieved investment returns of unsurpassed levels by choosing to focus on “intrinsic value” over market price.

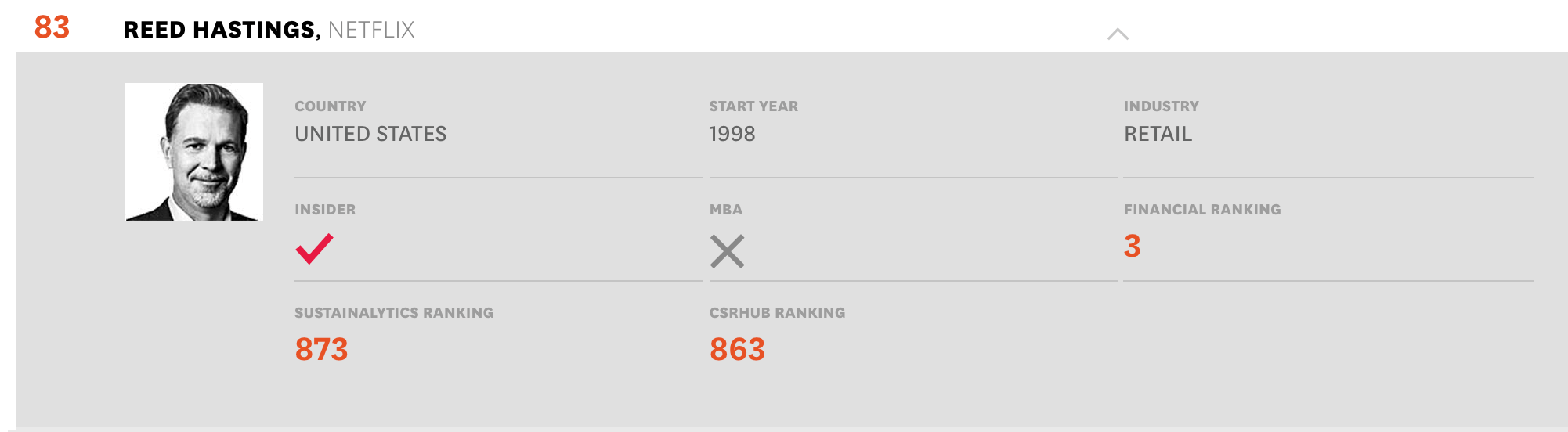

Now, let us go a bit further into Marla’s question by looking at one very well known CEO in that list from the Harvard Business review, Reed Hastings, CEO of Netflix.

HBR “Best-Performing CEOs” ranks 881 CEOs. 80% weighting to shareholder returns, 20% to two sets of ESG measures. Reed Hastings ranks near last on ESG but high share price drives an overall rating of 83rd of 881. What say @kilkenomics aliumni? @mdvex @KateRaworth @Marladukharan pic.twitter.com/hv89pxHOGZ

— Tom McCallum (@TomCayman) October 28, 2018

To explain a little more, the “Financial Ranking” is all about shareholder return over the tenure of the CEO, and on this Reed Hastings, longtime CEO of Netflix, ranks 3rd overall out of 881 CEOs measured. However, on ESG (Environmental, Social and Governance), he ranks 873rd and 863rd overall. Yes, in the bottom 2% of the 881 CEOs measured.

Still, we are what we measure. So a CEO who measures in the bottom 2% in ESG can still rank 83rd of 881 (or in the top 10%) of CEOs overall, so making the top 100 list of “The Best-Performing CEOs in the World”.

At this stage, please understand that this is not any kind of analysis, assessment or judgment of Mr Hastings, Netflix or the Harvard Business Review, but simply that shining a light on the massive difference for Mr Hastings between the metrics used by HBR.

To Marla’s question, then, my answer is that we operate in a business world that has taken the original thoughts of Adam Smith and reduced them to a Gordon Gekko soundbite of “greed is good”. We reduce the thoughts of “The Wealth of Nations” to defending “classical” economics around not only the idea that acting out of self-interest is a universal good, but that we humans measure that in purely financial terms.

In a few days, I will once again be off to Kilkenomics in Ireland to listen to global top Economists (including Marla) discuss the issues of the day. Last year one recurring theme was that traditional (I was studiously corrected from the word “classical” so edited the post accordingly.. and yes, classical and neo-classical are different!) economics is no longer fit for purpose (nor has been for quite some time), yet nobody has an alternative.

Now, on intrinsic value and other such issues of real business value, we have a repeat Kilkenomist this year in the oft scathing twitter voice of Mike Driver. Mike and I both have career backgrounds in building and realising business value, hence we do have some alignment of thinking, plus he is (not often shared on his twitter!) very widely read and has fascinating views. I look forward to his thoughts on such issues as CEO pay and performance and general inequality.

However, last year at Kilkenomics we also had Kate Raworth, who has brought forward an alternative way to measure value in our world with Doughnut Economics. Kate isn’t coming this year, so I hope Marla and others can bring forth some other ideas to challenge what it is we measure.

Let me close with a quote from Churchill. I offer to you the thought of exchanging the word democracy for capitalism, or economics and otherwise adjusting the quote.

‘No one pretends that democracy is perfect or all-wise. Indeed it has been said that democracy is the worst form of Government except for all those other forms that have been tried from time to time.…’