Sometimes you just need to jump on an opportunity if you know it is right. How do you know? Trust then verify, plus take a long view. Talk to a trusted source, verify their recommendation, but then (key) you need to take a long view, not a short-term one.

Sometimes if you fail to jump on an opportunity, you then miss that boat as the opportunity disappears.

As examples on an individual level, two from the UK:

- In 2021 some locked in multi-year deals on utility rates over a year ago at higher rates than the variable rates they were then paying. Why? As they could see rates would skyrocket so paid 40% more at that time than their current bills, but now are paying far less than others who did not think ahead (reader, I planned ahead).

- Also, some locked in multi-year fixed-rate mortgages in 2021 as they could see rates would increase over time as the cost of the Covid rescue packages would have a definite inflationary impact. This came to pass and rates locked in at under 1.5% in early 2021 were well over 2.5% a little over a year later, only to skyrocket to about 6% after the disastrous mini-budget announced very recently. Those with locked-in rates both planned ahead and limited their downside risk (a downside risk which is now impacting millions.

Now imagine a once-in-a-lifetime situation where a whole country could raise finance for transformational change to their economy at an interest rate of 1% and not have to pay it back for a century. As a national leader would you take that opportunity or would you let it slide as you focussed on the short term, or perhaps deemed it too good to be true?

Well, this really happened, and many countries, (including Cayman, told about this by me, and Ireland, by David McWilliams) missed this massive opportunity.

In mid-2020, the Austrian Government raised $1bn at 0.88% on a 100-year bond, taking advantage of historically low rates available in the market for long-term high-rated debt raises.

Around that time I talked to whoever I could in Cayman to recommend that they do something similar in order to fund a “Cayman National Investment Fund” that could have then financed the transformation of that small country with a focus on being a green leader regionally and even globally. At the time we were all locked down in our homes much of the time, yet as a Caymanian living in London I would still not have been able to connect closely enough to all of the issues related to this back home in Cayman, so I may well have missed some context as to why my ideas were not taken seriously. That said, my perception is that this small country with tiny national debt (under 10% of GDP) and a healthy annual government budget surplus could not see the benefit of such a large financial raise, only a historical fear of “borrowing” (reader, when raised to invest, it is finance, very different from borrowing such as the UK government, with well over 100% debt to GDP does).

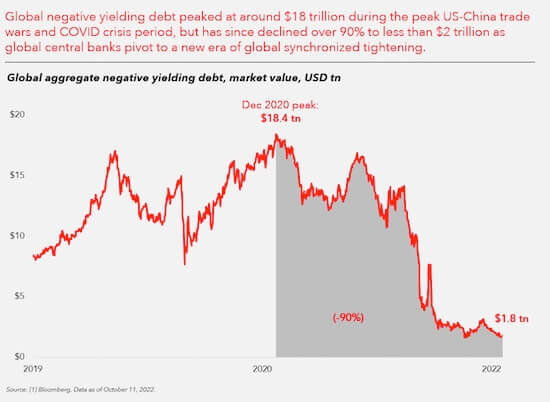

Anyway, this week Mark Blyth posted the tweet below, noting that many had missed the boat that Austria jumped on, as such funding is definitely not available now. Yesterday David McWilliams retweeted Mark’s tweet below, noting:

“Remember when we could’ve financed all Ireland’s public housing needs at negative real rates? Pissed that one up against the wall too!!”

Sometimes when an opportunity is there, take it, don’t wait.

Remember that time when we could have locked in all the financing that was ever needed to do the Green Transition at a negative real rate? Yeah – we pissed that one again the wall too: pic.twitter.com/pRzPGltWhl

— Mark Blyth (@MkBlyth) October 12, 2022